Nine-month 2017 revenue of €936m

Organic growth of +11.6% in Q3 2017 vs Q3 2016(at Constant Exchange Rates)

Highlights

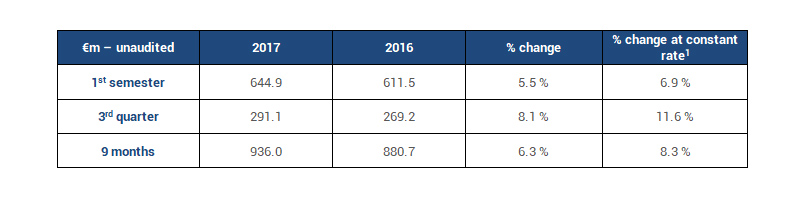

• Over the nine-month period ending 30 September 2017, in the context of a worldwide automotive production up by 2.6%, Novares Group posted €936.0 million in revenue compared to €880.7 million in pro forma revenue last year for the same period, which represents +6.3% growth and +8.3% growth at constant exchange rates1.

• During the third quarter of 2017, Novares Group revenue totalled €291.1 million compared to €269.2 million on a pro forma basis for the same period last year, which represents +8.1% growth and +11.6% growth at constant exchange rates1.

• New commercial successes include business wins for Ford Explorer on inside handles (USA), Toyota Yaris on interior and exterior parts (France) and Buick Envision air vents (China).

• Innovation as lever for growth and performance: In August 2017, Novares brought to market two Pillar innovations² for Volkswagen Wolfsburg which resulted in a new production order for 4,800 vehicles per week over the coming months.

• Major investment milestones carried out in the third quarter to support Group’s growth.

• The Group fully confirms its 2017 guidance and 2019 objectives.

Pierre Boulet, CEO of Novares commented: “Our outstanding performance of 8.3% organic growth over the first nine months of the year is the result of our capability to support our customers worldwide. The Key Plastics integration is progressing smoothly. It’s an exciting period for us now, especially with our new Novares brand that has created a very positive dynamic internally as well as for customers.”

Consolidated revenue (January 1st – September 30th)

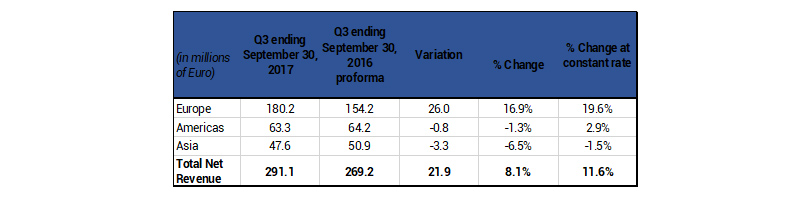

Consolidated revenue for the 3rd quarter ended 30 September 2017

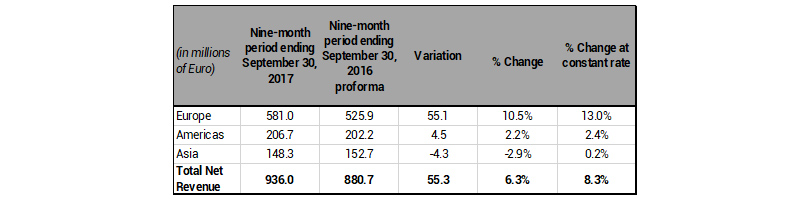

Consolidated revenue for the 9-month period ended 30 September 2017

Europe

So far, this year, business has been buoyant in Europe representing 62.1% of Group revenue versus 59.7% for the same period last year. Revenue reached €581.0 million versus €525.9 million for the same period last year, an increase of 10.5% driven by (i) high demands from PSA on the latest SUV range (3008 and 5008) in France and Slovakia, (ii) sustained activity in the UK and in Turkey and (iii) increasing design and tooling revenues addressing new projects ramp-up in the wake of strong order awards compared to the same period last year. The Group’s plant in Mioveni, Romania, started production operations during the third quarter. This growth was tempered by adverse exchange rate impacts in the UK and Turkey which resulted in a -2.5% impact.

Americas Region

Americas remained stable at 22.1% of Group revenue. Revenue totalled €206.7 million versus €202.2 million for the same period last year, an increase of 2.2%. This increase was fuelled by a revenue growth in Mexico (Puebla, Silao, Chihuahua) answering to Volkswagen and Audi model ramp-ups thus offsetting lower volumes in the United States.

Asia

Asia represented 15.9% of Group revenue versus 17.3% for the same period last year. Revenue totalled €148.3 million versus €152.7 million for the same period last year, a 2.9% decrease driven by adverse exchange rate effects and an unfavourable mix between end of life product ramp-downs and program renewal ramp-ups.

Major investment milestones in the 3rd quarter to support Group’s growth:

• New production plant opened in Mioveni, Romania.

• State-of-the-art automated painting line launched in Sainte Marguerite, France.

• Construction of a new production plant in Kenitra, Morocco progressing according to plan.

• Injection molding machines and plant production layouts are currently being set-up according to plan in Chihuahua, Mexico.

Novares fully confirms it 2017 guidance and 2019 objectives:

Bolstered by a strong level of activity, Novares is confident that it will meet its 2017 guidance:

• Revenues of €1.20 to €1.25bn

• Adjusted EBITDA of €100 to €105m

• Adjusted current operating income of €60 to €65m

• Capital expenditure of c. €80m (excluding tooling)

• Net debt of c.€190m and leverage ratio below 1.9x

Novares also confirms its 2019 objectives:

• Revenue growth at a CAGR of over 7% in 2018 and 2019 (at constant exchange rates, excluding changes in the cost of raw materials and before the impact of acquisitions over the period)

• Adjusted EBITDA margin of over 10% as from 2019

• Adjusted current operating income margin of between 6% and 6.5% (at constant exchange rates, excluding changes in the cost of raw materials and before the impact of acquisitions over the period)

• Maintaining a leverage ratio below 2x

About Novares

Mecaplast – Key Plastics rebranded as Novares on 19 September 2017.

Novares is a global plastic solutions provider that designs and manufactures complex components & systems serving the future of the automotive industry. Novares creates and produces cutting edge automotive parts and specializes in technical plastic injection that contributes to cleaner, lighter, more connected, user-friendly cars.

Novares provides engineering and manufacturing expertise to virtually every OEM and many Tier-1 companies in the automotive market. In 2016, Novares generated pro forma revenues of 1.2 billion euros3.

Headquartered in France, Novares is present in 21 countries, runs 42 manufacturing plants, 7 Skill centers, 5 Technical centers, 17 customer service centers, around the globe to partner with customers.

DISCLAIMER

This announcement contains forward-looking statements. Such information is not historical data and should not be interpreted as guarantees that the facts and data set forth will take place. This information is based on data, assumptions, and estimates considered reasonable by Novares, as described in particular in chapters 12 and 13 of the registration document filed with the Autorité des marchés financiers on 6 October 2017 under number I.17-069 (the “Registration Document”). It is subject to change or modification due to uncertainties related in particular to the economic, financial, competitive, and regulatory environment. In addition, the materialization of certain risks described in Chapter 4 “Risk Factors” of the Registration Document may have an impact on Novares’ business, situation, and financial results as well as its ability to achieve its objectives.

This announcement includes pro-forma financial information for the combined group made of the Company and Key Plastics in relation to the twelve-month period ended 31 December 2016, the nine-month period ended 30 September 2016 and the quarter ended 30 September 2016 which has been prepared as if Key Plastics had been acquired by the Company on 1st January 2016. This pro-forma financial information is provided for information purpose only and does not represent the results of the Company that would have been achieved if the acquisition had actually been completed on such date.

1 Revenue at constant exchange rates is calculated by applying the exchange rate for the comparable period to a given period.

2 The A pillar needed to reach two safety conditions to comply with new US regulations. Condition 1 was to allow the Airbag deployment without any damages to the part. Condition 2 entitled FMVSS201 was to improve the B pillar to lighten impact for the passenger in a collision.

3 Pro forma financial information of Novares including the acquisition of Key Plastics, IFRS.